When Rio Rancho’s Heat Demands Cool Solutions

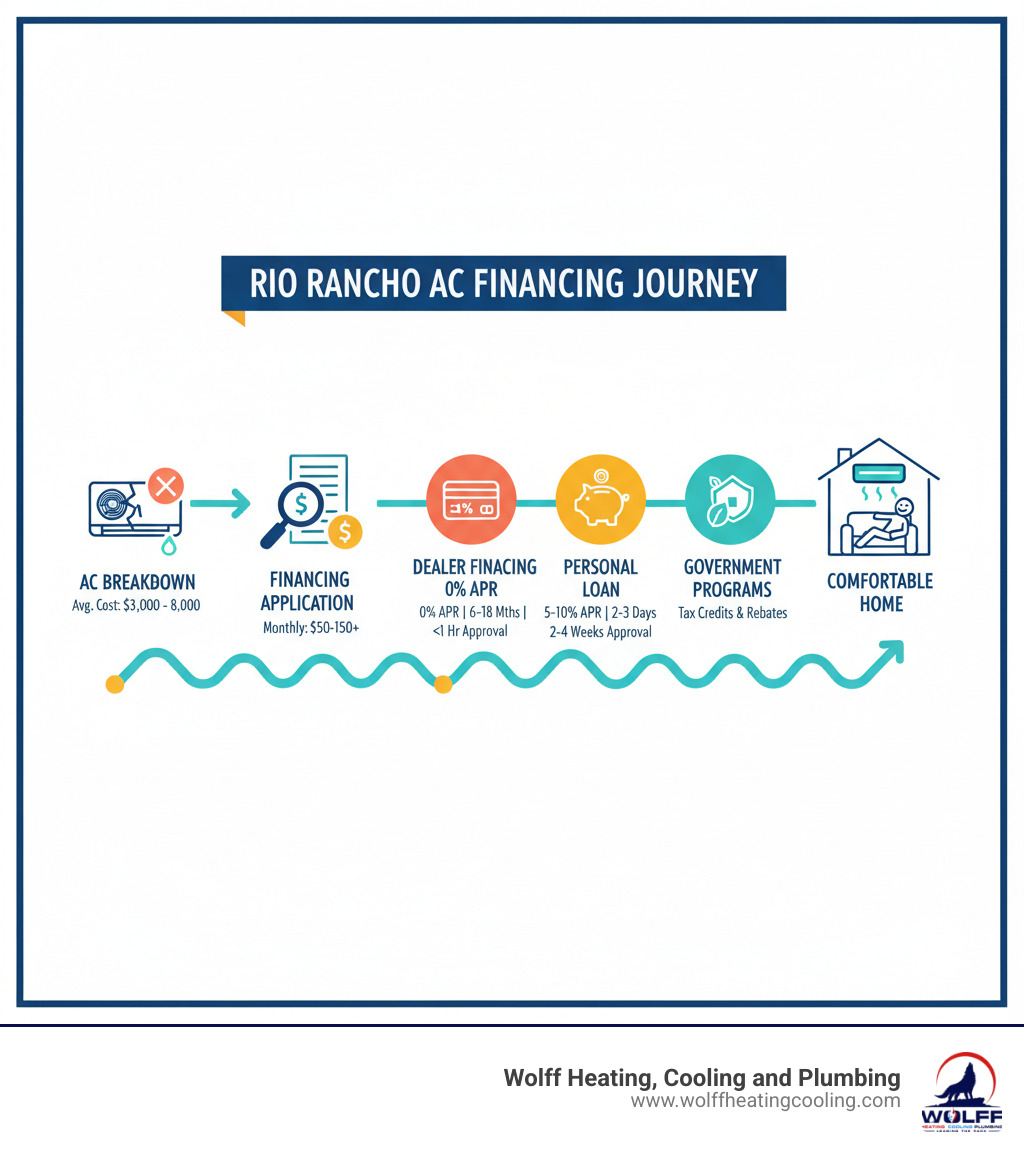

When ac financing options rio rancho become urgent, you’re likely dealing with a sudden breakdown in 90°F heat or a repair bill that’s bigger than expected. The good news: several financing paths can get your home cool again without draining savings.

Quick AC Financing Options in Rio Rancho:

- Dealer Financing – Promotional offers through trusted partners

- Personal Loans – Fixed rates from local banks and credit unions

- Credit Cards – Introductory offers for smaller repairs

- Home Equity Loans – Potentially lower rates for major replacements

- Government Programs – Federal tax credits and utility rebates to reduce total costs

A malfunctioning air conditioning system can quickly turn your home uncomfortable. In Rio Rancho’s summer heat, getting relief fast matters.

Financing turns a large, unexpected expense into manageable monthly payments. Whether you need emergency repairs or an energy-efficient upgrade, understanding your options helps you choose what fits your budget and timeline.

Breaking Down the Major Types of AC Financing

When your AC quits during Rio Rancho’s blazing summer, the bill can sting. Financing can bridge the gap—spreading costs into predictable payments so you can restore comfort now and pay over time. For guidance on new system installations, see our AC Installation Albuquerque, NM guide.

Here’s how the main financing options stack up against each other:

| Financing Type | Interest Rates | Best For | Key Risks |

|---|---|---|---|

| Manufacturer/Dealer | Often features promotional 0% APR periods, followed by competitive fixed rates for longer terms. | New installations, major replacements, or when you can pay off the balance during the promotional period. | Deferred interest if not paid in full, specific to HVAC purchases, tied to a single provider. |

| Personal Loans | Fixed APRs that vary based on creditworthiness. | Both repairs and replacements, when you prefer fixed payments and don’t want to use your home as collateral. | Potentially higher interest rates than secured loans, can impact debt-to-income ratio. |

| Credit Cards | Can offer 0% APR introductory periods, but standard rates are typically high. | Smaller, unexpected repairs you can pay off quickly, or when you need immediate funds. | Very high APRs after introductory period, easy to accumulate debt. |

| Home Equity Loans/HELOCs | Often have lower, variable rates tied to the prime rate. | Large projects, energy-efficient upgrades, or when you have significant home equity. | Your home is collateral, risk of foreclosure if payments are missed, longer approval process. |

Manufacturer and Dealer Financing

Dealer financing is convenient—choose your system and apply in one place. We partner with established lenders to offer promotional options, including 0% APR periods and competitive fixed terms, often with same-day approval. Third-party lenders like Synchrony, Wells Fargo, and GreenSky commonly support HVAC projects.

Always review terms carefully. Many 0% APR offers include deferred interest if the balance isn’t paid by the deadline. We’ll walk you through the fine print so there are no surprises.

Personal Loans

Personal loans are unsecured, so your home isn’t used as collateral. You’ll get fixed rates and predictable monthly payments. Shop local banks, credit unions, and online lenders to compare terms. It’s a solid choice if you want flexibility without tapping home equity. For repair details, visit our AC Repair Albuquerque, NM page.

Credit Cards

Great for smaller emergencies if you can leverage an introductory 0% APR and pay it off quickly. You’ll get fast access to funds and potential rewards—but be cautious. Once promos end, standard rates are high, and balances can snowball if not managed carefully.

Home Equity Loans & Lines of Credit (HELOCs)

If you have equity, these options often deliver the lowest rates for major upgrades. Home equity loans provide a fixed lump sum; HELOCs offer revolving access. Interest may be tax-deductible depending on your situation. Approval takes longer and your home is collateral, so use thoughtfully for larger projects.

Understanding Your AC Financing Options in Rio Rancho

Rio Rancho’s desert heat regularly pushes past 90°F. When AC fails, it’s urgent—not optional. Financing helps you restore comfort quickly by converting large, unexpected costs into affordable monthly payments.

How Local HVAC Companies Structure Their AC Financing Options in Rio Rancho

As a local HVAC contractor, we work with trusted financial institutions to offer straightforward financing for installations and major repairs. We provide application assistance and many partners offer soft credit pulls for pre-qualification, so you can review options without impacting your credit. You can also bundle multiple comfort projects into one plan. See our Residential HVAC Services Albuquerque, NM for a full picture of what we do.

Government Programs and Rebates for Rio Rancho Residents

Many energy-efficient upgrades qualify for federal tax credits and local utility rebates, lowering your total cost and the amount you need to finance. We stay current on available incentives and help you identify what your system may qualify for. Learn more via ENERGY STAR program benefits and Department of Energy recommendations. The DOE notes that replacing older units with efficient models can significantly cut cooling costs; regular maintenance can also reduce energy use.

Typical Interest Rates and Terms to Expect

Promotional 0% APR offers are common for a set period, provided the balance is paid in time. For longer terms, fixed-rate plans offer predictable monthly payments. Longer loans reduce the monthly payment but raise total interest; shorter terms do the opposite. We’ll help you choose what fits your budget and goals.

How to Choose and Apply for the Right Financing

Choosing ac financing options Rio Rancho is about fit—matching your project and budget to the right plan. With 25+ years serving local families, we help you compare terms so your decision is confident and clear.

Key Factors for Choosing Among AC Financing Options in Rio Rancho

- Total project cost: Use 0% intro credit cards for small repairs you can pay off quickly; consider dealer financing or personal loans for full replacements.

- Credit score: Strong credit open ups the best promos and rates. If your score isn’t perfect, there are still options—just expect slightly higher APRs.

- Payment comfort: Longer terms lower monthly payments but increase total interest; shorter terms cost less overall.

- Promo vs. fixed rates: 0% promos are great if you can pay off on time; otherwise, fixed-rate plans offer predictable, stress-free payments.

- Fees: Account activation or origination fees can add to total cost. We’ll outline them upfront.

The General Application Process

- Pre-qualification: Many partners use soft credit pulls so you can explore terms without impacting your score.

- Application: Quick, guided applications—often completed at your home or online.

- Documentation: Typically basic ID, income, and residency; secured loans require additional items.

- Approval and funding: Many dealer options approve within minutes, with funds available in 24–48 hours. For choosing equipment, see Choosing the Best AC in Albuquerque.

What Credit Score Do You Need?

Requirements vary by lender and product. Good to excellent credit earns the best promos and rates, but fair credit can still qualify through specialized programs. Your score affects APR, yet the monthly difference can be modest. Timely payments on an installment loan may also help build your credit over time.

Frequently Asked Questions about AC Financing in Rio Rancho

Can I finance minor AC repairs, or is it only for full system replacements?

You can finance major repairs as well as full replacements. Lenders often set minimum loan amounts; if your repair meets that, you’re set. Many homeowners bundle a repair with maintenance or air quality upgrades to maximize financing. Comfort and safety shouldn’t wait in summer heat.

How quickly can I get approved for AC financing?

- Dealer financing: Decisions in minutes; funding usually within 24–48 hours.

- Credit cards: Immediate if you have available credit; new cards may approve online quickly.

- Personal loans: Often a few business days.

- Home equity loans/HELOCs: Typically several weeks, so not ideal for emergencies.

Can financing a new, energy-efficient AC unit actually save me money?

Often, yes. High-efficiency units can cut cooling costs significantly—up to 40% versus older equipment, per DOE guidance. You’ll also reduce repair risk and may qualify for tax credits and utility rebates. Proper maintenance further boosts efficiency; learn more on our AC Maintenance Albuquerque Homes page.

Stay Cool and Comfortable with the Right Financing

With today’s ac financing options Rio Rancho homeowners can restore comfort fast—without straining the budget. From 0% APR promos to fixed-rate loans or home equity solutions for larger upgrades, there’s a plan that fits.

Wolff Heating, Cooling, and Plumbing has served the Albuquerque–Rio Rancho area for over 25 years with superior work, honest estimates, and local expertise. We’ll explain terms clearly and never pressure you into a plan that isn’t right for you.

Ready to explore practical, affordable options? Explore your HVAC financing options with us today!

Life’s too short to sweat the big AC bills.